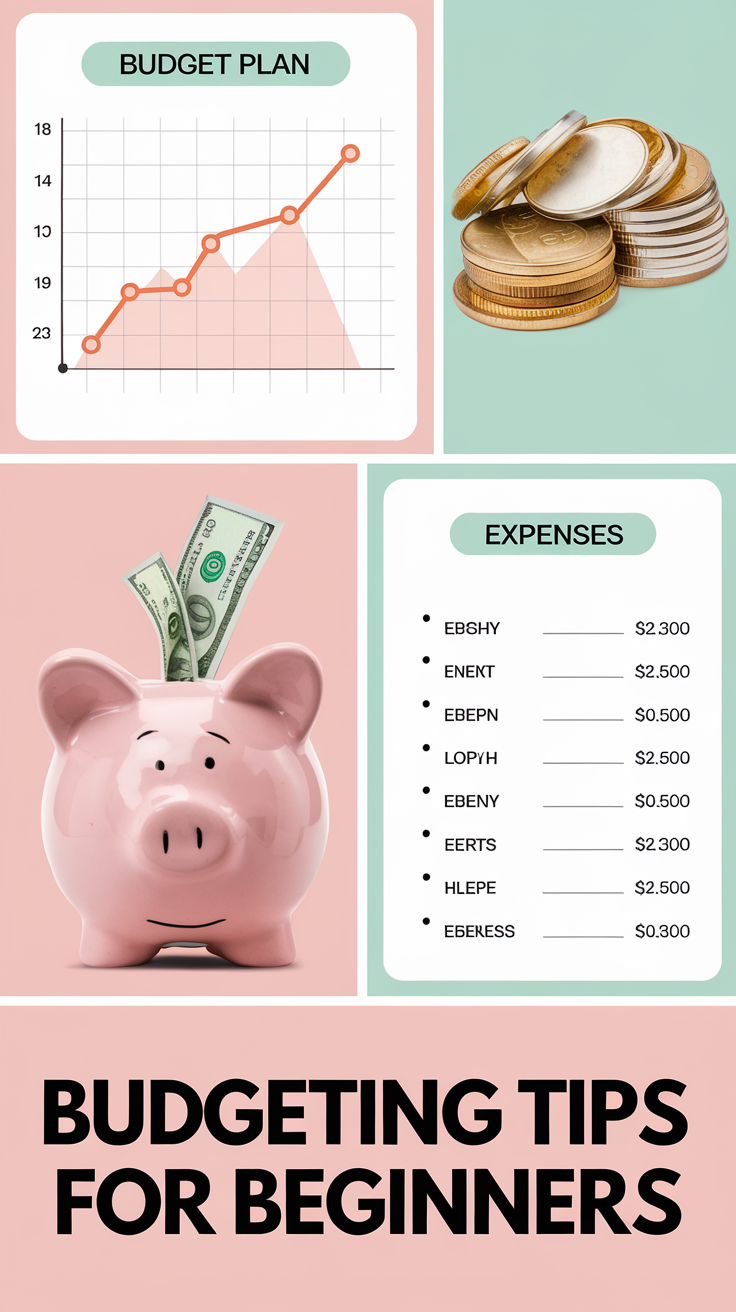

Budgeting Tips for Beginners

Embarking on the journey to financial stability begins with mastering the art of budgeting. As someone who has navigated the complexities of personal finance, I understand the challenges and rewards that come with effective budgeting. This guide provides practical, easy-to-follow tips tailored for beginners, ensuring you can confidently take steps toward achieving your financial goals.

Why Budgeting Matters

Budgeting is more than just tracking expenses—it’s about taking control of your financial future. A well-structured budget helps you prioritize spending, avoid debt, and build savings. Budgeting alleviates financial stress by providing a clear roadmap for your finances.

Step-by-Step Guide to Creating Your First Budget

1. Calculate Your Net Income

Start by determining your total take-home pay after taxes and deductions. Include all income sources, such as salaries, freelance work, or passive income. Knowing your net income is the foundation of an effective budget.

| Income Source | Monthly Amount ($) |

|---|---|

| Salary | 3,000 |

| Freelance Work | 500 |

| Passive Income | 200 |

| Total Income | 3,700 |

2. Track Your Expenses

Monitor your spending habits to understand where your money goes. Categorize expenses into:

- Fixed costs: Rent, utilities, insurance.

- Variable costs: Groceries, entertainment, dining out.

Use tools like spreadsheets or apps to track expenses for a few months to gain accuracy. This insight reveals areas where you can cut back.

3. Set Financial Goals

Define clear, achievable objectives, such as:

- Building an emergency fund.

- Paying off debt.

- Saving for a vacation or major purchase.

Goals provide motivation and direction for your budgeting efforts.

4. Choose a Budgeting Method

Pick a budgeting strategy that aligns with your lifestyle:

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This balanced method is easy to follow.

- Zero-Based Budget: Assign every dollar a job so that income minus expenses equals zero. This promotes intentional spending.

- Envelope System: Use cash for specific categories, allocating physical amounts to envelopes. This method curbs overspending.

5. Allocate Funds to Each Category

Distribute your income across categories based on priorities. A sample budget might look like this:

| Category | Allocation ($) |

| Rent/Mortgage | 1,000 |

| Utilities | 200 |

| Groceries | 400 |

| Transportation | 200 |

| Savings | 600 |

| Entertainment | 200 |

| Miscellaneous | 400 |

| Total | 3,000 |

6. Monitor and Adjust Your Budget

Review your budget monthly to compare actual spending against your plan. Adjust allocations as needed for unexpected changes in income or expenses.

Overcoming Common Challenges

Emotional Spending

Identify emotional triggers for overspending (e.g., stress, boredom) and find healthier outlets, like exercising or hobbies, to manage them.

Unexpected Expenses

Set up an emergency fund to cover unforeseen costs like medical bills or car repairs. Start small, aiming for at least $500, and build from there.

Staying Motivated

Celebrate small milestones, like paying off a credit card or saving $1,000, to stay motivated. Share your goals with a trusted friend or family member for accountability.

Practical Tools and Resources

Budgeting Apps

Leverage apps to simplify budgeting:

- Mint: Free app that tracks spending and categorizes expenses.

- YNAB (You Need a Budget): Paid app with proactive budgeting features.

- EveryDollar: User-friendly app for zero-based budgeting.

Templates and Spreadsheets

Use free online templates to create customized budgets. Google Sheets and Excel offer easy-to-use options.

Tips for Managing Debt

Snowball Method

Pay off smaller debts first while making minimum payments on larger ones. This creates quick wins and builds momentum.

Avalanche Method

Focus on debts with the highest interest rates to save money over time. This method minimizes overall interest paid.

| Debt Repayment Strategy | Focus Area | Suitable For |

| Snowball Method | Smallest debt first | Quick wins and motivation |

| Avalanche Method | Highest interest rate | Long-term cost reduction |

Savings Strategies

Automate Savings

Set up automatic transfers to your savings account. This ensures consistent contributions toward goals like an emergency fund or retirement.

Short- and Long-Term Goals

- Short-Term: Save for vacations, holidays, or small purchases.

- Long-Term: Plan for retirement or major life events like buying a home.

FAQs

1. How do I budget with irregular income?

Estimate your average monthly earnings based on past data. Prioritize essential expenses and adjust discretionary spending based on actual income.

2. What should I do if I overspend in a category?

Reduce spending in another category to maintain balance. Regularly review your budget to prevent recurring overspending.

3. How can I stay disciplined with my budget?

Set clear goals, track progress, and use tools or apps to stay organized. Consider finding an accountability partner for extra motivation.

4. What’s the best way to handle unexpected expenses?

Build an emergency fund to cover unforeseen costs. Start small and aim for three to six months’ worth of expenses.

5. Should I adjust my budget over time?

Yes, review and revise your budget regularly to reflect changes in income, expenses, or financial goals.

6. Can I still have fun while budgeting?

Absolutely! Allocate a portion of your budget to entertainment and hobbies. The key is moderation and intentionality.

Conclusion

Creating and sticking to a budget is a powerful step toward financial empowerment. By following these comprehensive tips, you can build a personalized budget that aligns with your goals and lifestyle. Remember, the journey to financial wellness is a marathon, not a sprint. Stay consistent, review your progress, and celebrate your successes along the way.