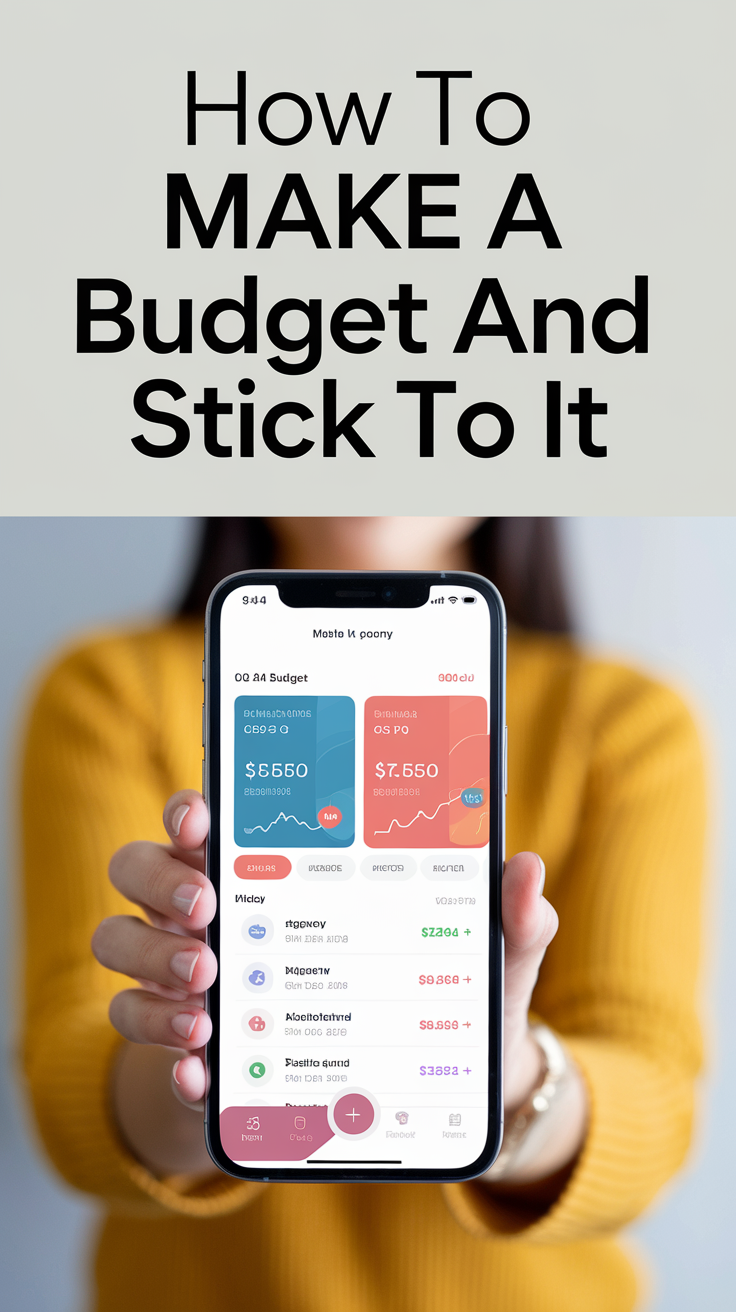

How to Make a Budget and Stick to It: A Step-by-Step Guide

Taking control of your finances starts with a solid budget. When you create a realistic plan and stick to it, you open the door to financial freedom. Let me guide you step-by-step through this essential process to help you achieve your financial goals.

Calculate Your Net Income

Your net income is the foundation of your budget. It represents the money you have after taxes and deductions.

How to Calculate It

- Add up all income sources, including salary, freelance work, and side hustles.

- Deduct taxes, insurance premiums, and retirement contributions.

- Use this figure as your budgeting baseline.

| Income Source | Monthly Amount ($) |

|---|---|

| Salary | 3,500 |

| Freelance Earnings | 1,000 |

| Total Net Income | 4,500 |

This clear view of your income helps prevent overestimating your spending capacity.

Track Your Spending

Tracking your spending reveals where your money is going. It’s often an eye-opener and can highlight areas where you can save.

Categories to Analyze

- Fixed Expenses: Rent, utilities, insurance.

- Variable Expenses: Dining out, groceries, entertainment.

- Periodic Expenses: Subscriptions, annual fees.

| Expense Category | Weekly Spending ($) | Monthly Total ($) |

|---|---|---|

| Fixed | 800 | 3,200 |

| Variable | 200 | 800 |

| Periodic | 50 | 200 |

Use tools like budgeting apps or spreadsheets for accurate tracking.

Set Clear Financial Goals

Setting goals gives purpose to your budget. Without clear objectives, sticking to your plan becomes harder.

Types of Goals

- Short-Term: Save $1,000 for emergencies within six months.

- Long-Term: Save $20,000 for a house down payment over three years.

Pro Tip: Break long-term goals into smaller milestones. For example, saving $5,000 a year feels more manageable than $20,000 over three years.

Choose a Budgeting Method

No single budgeting approach works for everyone. Choose one that fits your needs.

Popular Budgeting Methods

- 50/30/20 Rule:

- 50% for essentials.

- 30% for wants.

- 20% for savings and debt.

- Zero-Based Budget:

- Every dollar is assigned a purpose.

- Envelope Method:

- Allocate cash to spending categories.

Use this table to compare methods:

| Method | Pros | Cons |

|---|---|---|

| 50/30/20 Rule | Simple, flexible | May not work for irregular incomes |

| Zero-Based Budget | Maximizes control | Time-consuming |

| Envelope Method | Great for reducing overspending | Less practical for online payments |

Allocate Funds Accordingly

Once you choose a method, distribute your income into categories. Here’s an example for a $4,500 income using the 50/30/20 rule:

| Category | Allocation ($) |

|---|---|

| Needs (50%) | 2,250 |

| Wants (30%) | 1,350 |

| Savings (20%) | 900 |

Customize these allocations based on your priorities.

Build an Emergency Fund

An emergency fund acts as a safety net. It helps you handle unexpected expenses without derailing your budget.

Steps to Build Your Fund

- Start with $1,000 for immediate needs.

- Gradually save 3-6 months’ worth of living expenses.

Behavioral Strategies for Sticking to Your Budget

Creating a budget is one thing—sticking to it is another. Here are strategies to make it easier:

- Automate Savings: Schedule automatic transfers to your savings account.

- Delay Gratification: Wait 30 days before making non-essential purchases.

- Visualize Goals: Keep reminders of your goals in visible places.

Monitor and Adjust Regularly

Your budget should evolve with your life. Regular reviews help you stay on track.

Review Checklist

- Compare actual spending to budgeted amounts.

- Adjust categories if your income or expenses change.

- Celebrate small wins, like meeting a savings goal.

FAQs

1. How do I handle irregular income?

Base your budget on your lowest expected monthly income. Save extra earnings during higher-income months.

2. What’s the best way to cut discretionary spending?

Track your non-essential expenses and set strict limits. Consider the envelope method for better control.

3. How do I recover if I overspend?

Identify the overspending category, reduce it next month, and consider reallocating funds from other categories.

4. What tools help with budgeting?

Apps like Mint, YNAB, and spreadsheets are excellent for tracking expenses and managing budgets.

5. How often should I review my budget?

Review your budget monthly to ensure it aligns with your goals and adjusts for changes in your financial situation.

Conclusion

Budgeting isn’t about restrictions—it’s about freedom. When you create a realistic budget and stick to it, you empower yourself to achieve your financial goals and reduce stress. Take the first step today, and you’ll thank yourself tomorrow.